The new government’s focus on housing sector has given a fresh lease of life to the real estate sector, which has been struggling under high interest rates and economic slowdown. The Reserve Bank of India has announced a series of measures to encourage lending to the housing segment, which falls under the category of priority sector lending.

Banks now have an avenue for raising long term funds via the 7 years bond to finance affordable housing and infrastructure projects. Home loans of upto Rs. 50 lac for houses of value upto Rs 65 lac in Metros, and loans upto Rs. 40 lac for houses of value of Rs. 50 lac in other cities will now be considered as affordable housing. This will make it easier to get loans in this price range and also you will be entitled to a lower rate of interest. As per former State Bank of India chairman Pratip Chaudhari interest rates on new home loans might fall by 40-50 basis points (0.5 percent). A back-of-the-envelope calculations shows that a 50 basis point drop in interest rate on a Rs. 50 lakh loan for 20 years will bring down EMIs by over Rs. 1,700 per month. Additionally, the increase in interest tax deductibility on home loans from Rs. 1.5 lac to Rs. 2 lac and Rs. 2.5 lac to Rs. 3 lac for senior citizens reduces your tax bill.

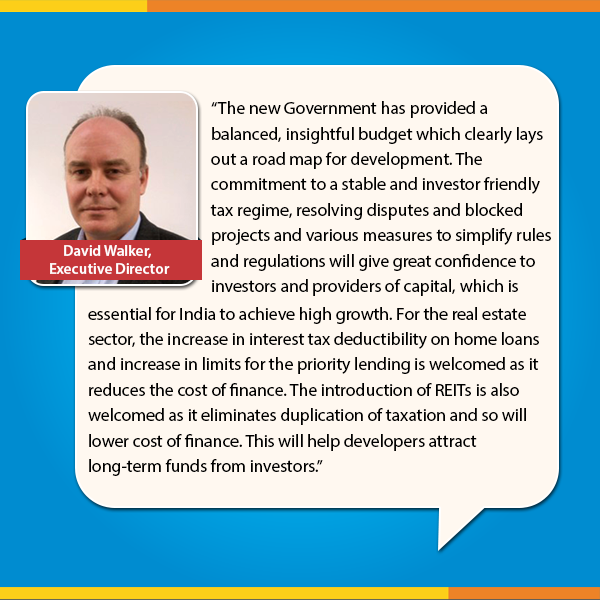

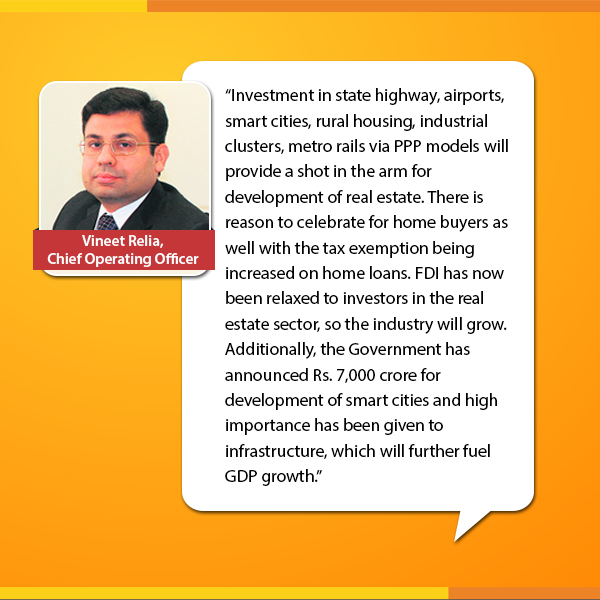

Here is what our leaders had to say: